Carmen García-Wang1 , Mercedes Grijalvo1![]() and Agustín Figueroa1

and Agustín Figueroa1

1 Universidad Politécnica de Madrid (UPM), Madrid, Spain.

Keywords: Sustainable development, climate finance, banks, business model.

1. Introduction, objectives and methodology

As environmental issues gain greater significance, companies and financial institutions are confronted with demands to play an active role to reduce environmental burdens effectively. Although the financial sector is not generally considered as environmentally friendly, financial institutions can play a major role showing how to make a profitable impact by reducing the effects of climate change. This fact means a change of paradigm [1] where financial transactions need to be aligned and related risks can no longer be analysed only within the economic bubble but together with social, ethical and environmental parameters . Within the banking sector, the collection of new business models prioritizing climate change and what it entails is referred to as Climate Finance. The role of banking institutions as one the major sources of financing investment is vital [2]. The question arises on whether banks are indeed ready to become catalyzers of climate finance.

Eric Usher, Head of UNEP Finance Initiative, states “a sustainable bank is one that not only understands and manages the risks that arise because of sustainability issues, but also perceives the strategic dimension of these issues. This means thinking ahead about business implications and opportunities brought by the increasingly pervasive environmental, social and developmental challenges of our time” [3]. Banks are in a unique position to improve the relationships with their clients by adopting drivers such as positioning themselves aligned with their clients’ values, broadening its product and services portfolio, or reducing the physical and transition risks that come with a climate- resilient economy. However, banks hesitate on financing the industry transformation due the lack of knowledge on how to become profitable from it. For this reason, this study focuses on the identification of key levers on banks’ business models that should be modified in order to leverage this business opportunity, looking to greening practices on the necessary Climate Finance transformation from conventional banking systems. Previous studies have already recommended banks to adopt a sustainable business model and given steps on how to achieve it, [4], but less literature has been written on the extent to which sustainability is already integrated into a bank’s business model and its effectiveness.

This paper is part of a larger work developed during a study at the Universidad Politécnica de Madrid [5] and the practical experience of World Bank expert, Agustín Figueroa. The research design for this paper is based on two main methodologies based on literature analysis and company-based studies. First, a thorough literature review on business models and sustainability-related practices. Followed by a case study to evaluate the validity of the Sustainable Business Model Structure identified on five specific banks, chosen through a series of steps based on research, analysis and categorization. Secondary sources have been used for these analyses, consisting mainly of banks’ annual reports, sustainability reports and websites. By comparing each bank’s content to each lever and sub-lever, the most common practices and focuses have been identified.

2. Adapting business model framework to the banking system

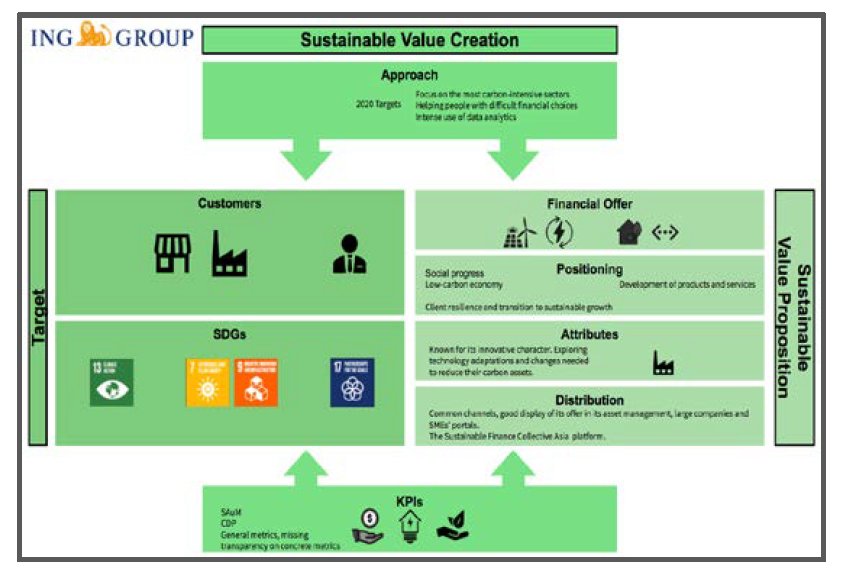

Three key levers have been identified for a sustainable business model for banks looking to boost climate: Target, Sustainable Value Proposition and Sustainable Value Creation. Through a case study comparing the application of the model to multi- national reference banks, a collection of best practices has been gathered to improve a bank’s profitability while reducing its clients’, as well as its own, contribution to climate change. Figure 1 displays the Sustainable Business Model Structure applied to ING Group to determine its progress on becoming a catalyzer of climate finance.

3. Conclusions

Banks are in a privileged position to improve the relationships with their clients and reduce their emissions thanks to the implementation of climate finance. By using the business model structure identified, new opportunities that bring added value can be discovered. This, together with the collection of best practices developed, provides any bank the chance to transform its business model and become catalyzers of a climate- resilient economy.

The main limitation of this study is in regards to the availability of the sources to be used. All information has been gathered from each bank’s Annual Report, Sustainability Report and website. The lack of transparency limits the analysis of the levers as well as the levers chosen themselves.

Acknowledgments. The authors would like to acknowledge the Spanish Agencia Estatal de Investigación, through the research project with code RTI2018-094614-B-I00 into the “Programa Estatal de I+D+i Orientada a los Retos de la Sociedad”.

References

- Triodos Bank Las Finanzas sostenibles. Estado de la cuestión y motivaciones para su desarrollo, https://www.triodos.es/es/foro-academico-finanzas-sostenibles, last accessed 2021/03/05.

- Laguir, I., Marais, M., El Baz, J., & Stekelorum, R.: Reversing the business rationale for environmental commitment in banking: Does financial performance lead to higher environmental performance? Management Decision, 56(2), 358-375, (2018).

- United Nations Environment – Finance Initiative – Partnership between United Nations Environment and the global financial sector to promote sustainable finance. https://www.unepfi.org/, last accessed 2020/09/03.

- Bocken, N. M. P., Short, S. W., Rana, P., Evans, S.: A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42-56, (2014).

- García, C. Climate Finance: a business opportunity and necessary transformation for banks. UPM, 2020.